Satellite communications are a longstanding technology that have remained inaccessible due to their higher costs – and arguably limited capabilities - compared to terrestrial networks. However, recent advances in the technology have seen direct-to-device (D2D) satellite connectivity gaining significant traction, with D2D now able to offer an easier and more cost-effective way for devices to access reliable connectivity.

D2D provides connectivity to smartphone users outside of cellular coverage areas, allowing them to use simple functions of their devices such as voice, SMS and basic data connectivity, with no device modifications required. D2D is now a viable connectivity solution in areas with restricted access to legacy infrastructure – and this in turn gives the technology huge potential for connecting the unconnected in emerging markets.

D2D connectivity is a convergence of satellite and terrestrial connectivity; devices which could previously only be connected via terrestrial means will now be connectable over satellite as well. While still very much in the early stages of market development, the ecosystem is enabling consumer and business devices to switch between satellite and cellular networks cost-effectively for the first time.

In nations with larger rural populations, this cost-effectiveness means D2D is democratizing access to resilient connectivity, says Simon Hawkins, Vice President of Commercial and Innovation at Viasat Enterprise. Countries with large populations and challenging terrain, including the Philippines and Brazil, have recently laid the regulatory foundations for trialling D2D – but beyond simply expanding connectivity, Hawkins believes that D2D will likely lower the barrier to digital transformation for enterprises across various sectors in emerging markets.

D2D is likely to have a particular impact in the transportation, energy, and utilities sectors, as it has the potential to improve logistics and enable more efficient remote management of critical infrastructure. There is also significant scope for D2D to help emerging nations manage their emergency response scenarios, with satellite connectivity enabling citizens to use SOS emergency beacons on their phones while cellular networks are down.

“We expect more consumers to become aware of potential use cases for satellite connectivity, particularly those who often venture into wilderness areas for leisure or work”, said Shivani Parashar, research analyst at Counterpoint Research. Overall consumer demand may not be strong, but certain segments, such as smartphone and IoT device users, will recognize enough value to seek out satellite-capable devices and be willing to pay for satellite services.

Currently, the smartphone satellite market is at a nascent stage, with only a few companies offering satellite services. Parashar expects devices will soon be equipped with satellite connectivity regardless of consumer demand, although notes that initial usage will likely be restricted to SOS services, limited messaging, and location sharing with emergency responders, in line with Hawkins’ prediction.

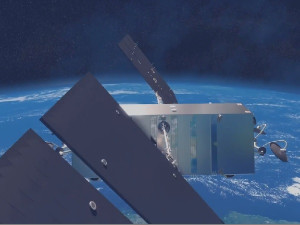

The increased use cases for D2D are driven by its improved commercial viability in lower income regions. Victor Xu, Industry Analyst at ABI Research, notes that there are several factors behind this, such as the declining cost of manufacturing and launching satellites as well as improvements in the capabilities of Low Earth Orbit (LEO) satellites.

While timeframes will vary by region and depend on factors such as regulatory approvals, partnerships between satellite operators and the local CSPs, and the pace of technological advancements, early services are already launching. Xu notes that Lynk Global has begun offering initial text messaging services in select regions, and while he cautions that it could be 10 to 15 years before the full potential of D2D is realized in these regions, markets with progressive regulatory environments and strong partnerships could see more rapid adoption of D2D services.

Standardisation

One major regulatory factor that has driven traction for D2D is the 3GPP Release 17, which has standardized a number of protocols, enabling higher volume chipset production and therefore more affordable devices, further reducing overall development costs. Parashar notes that 3GPP has worked with the satellite industry on a global standardized solution that is being incorporated into the 5G path in this release, with further enhancements to follow in Release 18.

According to Hawkins, standardisation is essential for driving D2D adoption. “For operators in emerging markets to start offering D2D-enabled services, it’s key that the industry takes a transparent, standards-based approach to accelerate the time taken for products to become commercially available for users, as well as providing more flexibility and choice for end users”, he argues.

Release 17 has introduced NR-NTN (radio-non-terrestrial network) services. Currently, 3GPP’s standards only allow for the provision of NB-NTN (narrow broadband-non-terrestrial network) services, where users can transmit small packages of data – e.g. emergency beacons and simple messaging applications - in remote locations. NR-NTN could offer a much wider range of connectivity services, including data-intensive use cases such as voice calls and broadband.

“It’s important to note this difference in D2D as it shows that we’re still in the early innings of this technology”, says Hawkins. “Large mobile network operators are already planning consumer rollouts of D2D that include NB-NTN services, but in the future there could be significant potential with NR-NTN networks.”

NTN 3GPP Release 17 focuses on narrowband capabilities suited for basic services like messaging and IoT communications, while Releases 18 and 19 will offer higher data rates over frequencies above 10 GHz, enabling real-time applications, HD video, and large-scale data transfers. This will advance the integration of satellite with 5G networks.

“Future releases by 3GPP will pave the way for NR-NTN networks, where we’ll see more and more features enabled by satellite connectivity, and this is where the potentially game-changing applications will come into play”, adds Hawkins.

Security Challenges

The increasing use of non-terrestrial networks and the launch of thousands of satellites will drive the need for reinforced national and international regulations to ensure the safe and secure operation of these networks.

Xu notes that there are several potential security risks and regulatory challenges associated with D2D satellite connectivity technology, including cross-border regulatory issues, jurisdictional challenges, vulnerability to interception, and cybersecurity threats. Parashar postulates that some countries may even outlaw direct-to-device satellite connectivity, while emphasising that Counterpoint expects licensing to gradually expand across regions.

“Government policies will play a crucial role, with some nations restricting satellite-based devices or requiring licenses for their operation” said Parashar. “As regulations for smartphone satellite connectivity evolve, they will significantly impact the industry, focusing on key areas such as licensing modifications, spectrum allocation, privacy concerns, and national security. These regulations will ultimately shape the trajectory and success of the smartphone satellite connectivity market.”

Most regulatory efforts do seem focused on developing frameworks to manage these risks rather than outright bans. The potential benefits of D2D technology, particularly in areas like emergency communications and connecting the underserved/remote/rural regions, are significant enough that regulators are more likely to seek ways to securely implement the technology rather than prohibit it entirely.

D2D can offset vulnerabilities in emerging markets around the lack of terrestrial infrastructure and a reliable energy supply – and regulators are recognizing the benefits, notes Marc Einstein, a Research Director at Counterpoint. Einstein highlights that regulators are increasingly allowing terrestrial mobile operators to share spectrum with satellite providers, enabling all mobile devices to receive satellite signals.

This has major ramifications in emerging markets where low-cost devices proliferate, which Einstein believes will improve attitudes towards the technology. “Many of the regulators I have spoken to recently are starting to realize that the D2D benefits far outweigh the costs, and hence I expect D2D connectivity to become considerably more common going forward”, concludes Einstein.