The spread of connectivity has transformed the economies of multiple developing markets enabling citizens from Asia, Africa and Latin America to tap into a myriad of information and services.

People in emerging markets have taken up mobile money to improve daily productivity, gain access to education through the internet, and broaden their horizons with insight to other cultures thanks to the proliferation of connectivity.

Connectivity is far from the great equaliser for emerging markets, but it is a vital tool to speed up the development of rising economies. However, it can only blossom with right decisions from stakeholders and support from governments.

The Nepalese market saw a massive bombshell in December as Axiata-owned Ncell, one of Nepal’s largest operators, announced its decision to sell its unit and exit after only seven years.

Group Chief Executive Officer and Managing Director of Axiata Vivek Sood said at the time: “It has led the Axiata board to conclude, after a thorough process, that our foray in Nepal cannot continue due to the unfavourable conditions for Axiata, the uncertain regulatory and tax environment, and the looming risks associated with the expiry of the mobile licence in 2029.”

Axiata entered Nepal after acquiring holding company Reynolds which held 80% of Ncell shares in 2016 for US$1.3 billion. The operator group paid NPR 47 billion (US$353.6 million) in taxes on top but the government reassessed the acquisition in 2021 and found a further NPR 57.9 billion (US$435.6 million) needed to be paid.

It was not only Axiata that has butted heads with the Nepalese government. Smart Telecom which operated under the Smart Cell brand had its licence revoked in April 2023, for repeatedly failing to pay for its renewal fee and subsequent fines totalling US$151 million. The operator was also scrutinised in 2019 for failing to make its payments.

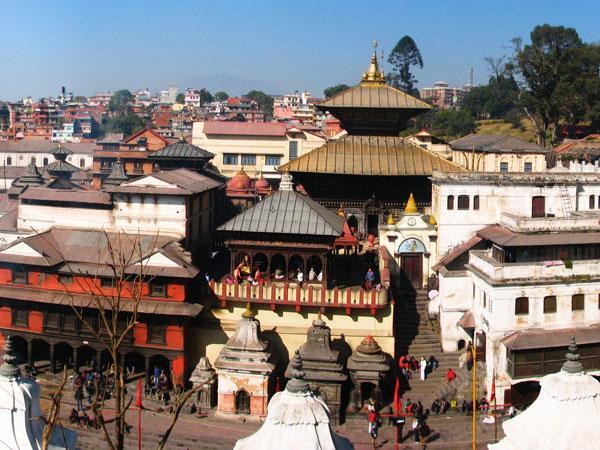

It seems to be a dire period for the Nepalese telecoms market which only opened its telecom market to other providers in 2003. Developing Telecoms spoke to analyst company Mordor Intelligence for more insight into Nepal, and why traversing the Nepalese market requires a strong fellowship and whether the government has been heavy-handed.

Stiff competition

The Nepalese telecoms sector is fiercely contested by four players: state-owned Nepal Telecom, Ncell Axiata Limited, Smart Telecom Private Limited, and Nepal Satellite Telecom.

Mordor Intelligence noted that the Nepalese government had long pointed out issues on dominance from larger players Ncell and Smart, and had taken steps to “foster fair competition and reduce levels of rivalry”.

Axiata was forced by Nepalese courts to pay the extra tax and dismissed its claims under bilateral investment contracts.

“The verdict strengthened Nepal’s capacity to enforce tax laws and regulatory compliance, setting a model for global firms. Axiata blasted conditions in Nepal, emphasising the expiration of its licence in 2029, double taxation, potential expropriation of Axiata’s stake by the government, and unfavourable foreign investment policies,” said Mordor Intelligence analysts.

Unfortunately battles between the operators and the government caused delays in expected procurement of Smart assets and licence sales.

Mordor Intelligence also noted how Nepal's telecom earnings fell by 42% in the previous fiscal year due to expensive licence costs, shifting client preferences, and foreign exchange losses. Challenges in the regulatory environment, such as capital gains tax, further compound the industry's difficulties.

Around US$1.8 billion is required in investment from the sector to attain universal access to high-quality connectivity by 2030. But operators have faced “immense pressure due to the recent decline in revenues and profits”, and “unfair taxation” which Axiata faced.

Deployment of 4G in emerging markets is still underutilised and such is the case in Nepal, which makes 5G deployment further away as the technology requires “three times” more investment that 4G. Nepal needs its industries to coordinate as it faces the challenges of power supply issues, high network infrastructure, and poor sustainable policies, said Mordor Intelligence.

After what seems to be several steps back, it will be interesting to see how the Nepalese telecoms market develops from here. Nepal will drop down to only two operators if Axiata is granted a smooth exit - however, that is being contested in court. More competition only benefits subscribers through more affordable devices and tariffs, actions must be taken now to prevent any further decline and prevent the slow march back to a monopoly.