At MWC 2019, we were briefed by President of Consulting & Service Solution Sales Dept., Carrier BG, Huawei and Steven Wu on how the vendor is prepared for the imminent arrival of commercial 5G.

How is Huawei helping to bring about the launch of global 5G?

Huawei’s service mission is to bring 5G into reality by offering the most advanced technologies, products and services in 5G. That said, the best product doesn’t mean the best network, and the best network doesn’t mean the best business. Good professional services will enable the network to perform better, to be better monetised, and to achieve better business results.

To this end, we are setting up our Digital Transformation Practice Centre (DTPC), which helps customers to incubate business ideas and collect best practice of digital transformation.

Huawei is working widely with global industry panels. 4G changed lives, but 5G will change society – industry application will be a very important trend of 5G. We have signed more than 30 commercial contracts and shipped over 40,000 5G sites globally.

What are the main challenges?

Digital transformation is not an easy journey. There are three main stumbling blocks; the first is culture. People are afraid of change, and it takes courage for them to change their minds to accept a new concept – this can be seen in examples as old as the unwillingness to accept steam engines or cars instead of horse-drawn carriages. Changing mindsets is difficult, which is why companies need to adopt a culture of transformation.

Second is strategy – having a clear, firm digital transformation strategy is essential, coupled with strong leadership to guarantee its execution. Thirdly, organisational processes – companies are used to traditional ways of working, but they need to rebuild these via digital transformation.

How long will 4G and 5G coexist?

When 3G was new, ten to fifteen years ago, operators were discussing when to end 2G services. In fact, 2G has survived up to today, because we need a fundamental network to provide basic services like voice and data. 4G will play this role in the era of 5G. In China and some European countries operators are considering shutting down their 2G networks, and following this VoLTE will become the base voice service, with traditional data services offered over 4G.

4G will be the fundamental network for operators to provide voice and data services for the foreseeable future, coexisting with 5G – and this makes co-optimisation very important. Solutions such as decoupling the uplink and downlink help us to improve performance by 10x. We have the top P3 ranking and the highest share of the optimisation market, with over 400 4G networks deployed globally. Our Rayce propagation model, together with our 3D simulation solutions, has already allowed us to increase site selection accuracy by 15%, allowing for the optimisation of customer investment.

Where else do efficiencies need to be improved?

5G site density will be more than that of 4G, so fast deployment is key for customers looking to achieve the first mover advantage. Our unique 360-degree panorama photo-scanning technology enables a digitised view of the site; this advanced knowledge of the site combined with our digital delivery allows for reducing 30% deployment period comparing with traditional approach. The lightweight camera is used by the engineer to scan the site and the data is collected automatically and mirrored automatically across other sites.

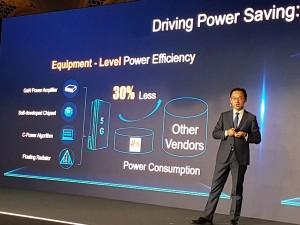

Cost of power will also be a heavy load for 5G operators. Based on 64T64R sites (i.e. maximum capacity) using massive MIMO, power consumption for 5G will be higher per site than for 4G. Helping customers save on the cost of this energy is a very important mission for technology providers. Huawei’s PowerMate solution can reduce power consumption by around 15% per site by dynamically shutting off the TRX according to the traffic.

Additionally, this consumption is estimated based on maximum capacity. In the initial stages, 5G networks will be deployed in ‘hot’ coverage areas and certain business cases, such as eMBB and FWA. This depends on business return, but data consumption is likely to increase by 4 or 5 times, so it’s a matter of ‘complete cost’ – the cost per bit will be much cheaper than with 4G. Vendors are conducting a lot of research into managing power consumption, and we’re aiming for ‘zero bit, zero watt’ – if there’s no consumption of data, then there is no consumption of power. With AI technology and automation, we are aiming for dynamic shutdown if the tech is not in use.

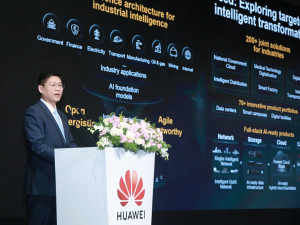

Is this the key function of AI in 5G networks?

Manual network optimisation at a 5G level is impractical - using AI and machine learning technologies improves efficiency by as much as 10x. The working load for 5G drive tests is huge due to the increased site density, and we’ve worked minimization of drive test (MDT). Our solution replaces the existing drive test, improving efficiency by as much as 6x. In MIMO networks the complexity is 100x that of a traditional network, but with our AI technologies we can improve capacity gain by 10% without adding additional hardware, demonstrating our optimisation capability.

Which other areas will benefit from digital transformation?

Operation and maintenance is another pain point – operators are currently running 2G, 3G and 4G networks together, and they’ll be adding another one soon. These are typically siloed and run with manual processes, which cannot work with 5G arriving. We have developed a new cloud-based platform that can digitise a customer’s assets, making assets visible and automating operational process via cloud, big data and AI technologies. This allows us to consolidate four systems into one platform.

We have a very complex solution that combines four antennae into one – 2G/3G low-band, 4G middle-band, and 5G high-band. This reduces the space taken on towers by 4 times, making it easier to find suitable sites. From a service point of view, our LIVESITE solution digitises all site information, allowing operators to survey locations and available space remotely. All public operator information can be consolidated to this platform, helping with site selection to more precisely plan, acquire and deploy.